If Chapter 7 bankruptcy is on the horizon, there will be a big question on your mind: how much property am I allowed to keep? The answer to this question is not the same for every person, as it is based on the type of property, how much it is worth, the exemptions that you can use, and the state in which you live.

Ohio Chapter 7 Bankruptcy Exemptions

Generally speaking, when you file for Chapter 7 bankruptcy, also known as Liquidation or Fresh Start, your assets will become part of the bankruptcy estate. At that point, a bankruptcy trustee is appointed by the court to sell these assets as a means of paying back creditors. That being said, just because you file does not mean that you have to give up all of your property. There are bankruptcy exemptions in chapter 7 filings in Ohio.

Chapter 7 Bankruptcy Exemptions allow you to keep some of your assets, ensuring that you are in position to make a fresh start once you exit bankruptcy.

In the case of a Chapter 7 filing, if you can put an asset in exempt status, the trustee is not permitted to sell it.

How much can I Exempt in a Chapter 7 Bankruptcy Filing?

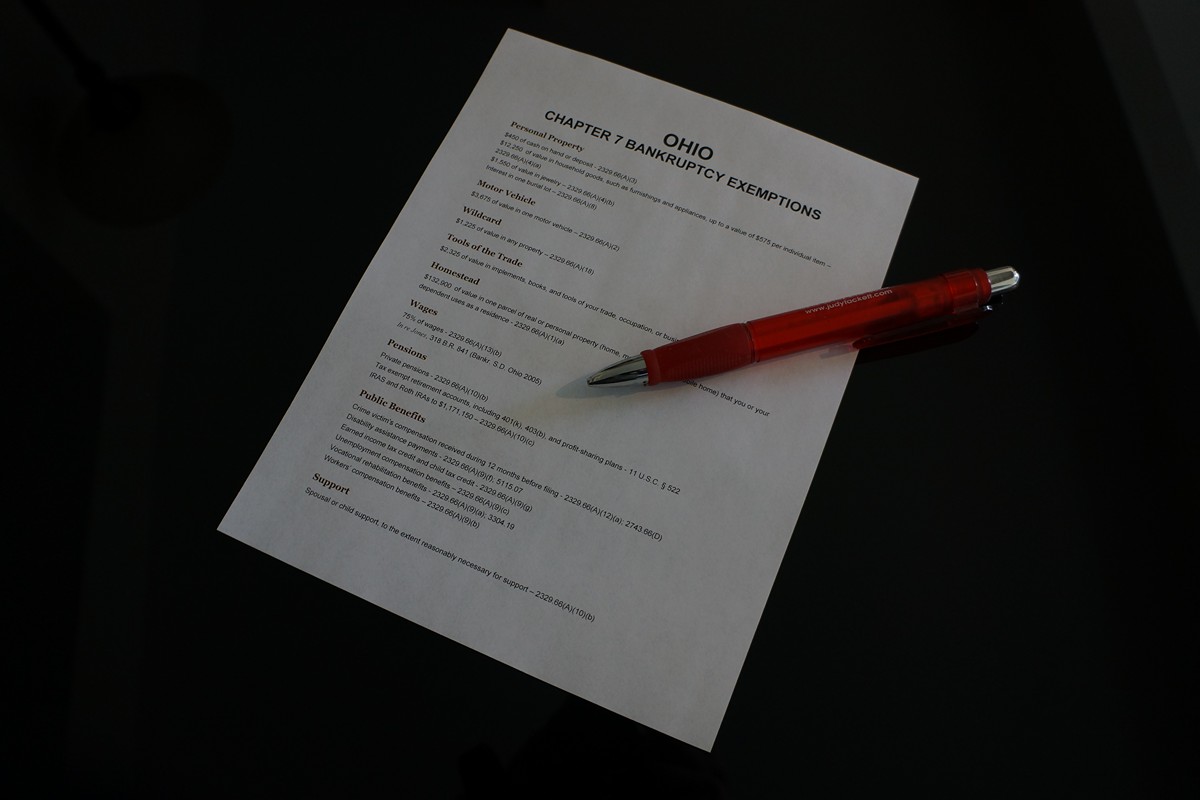

In addition to federal bankruptcy exemptions, there are also Ohio chapter 7 bankruptcy exemptions in place. Along with this, some states require that you use their exemptions while others allow you to rely on the federal system.

Note: the amount of property you can exempt will depend largely on the state in which you live.

Ohio, as well as the federal system, allows you to exempt property, such as money in bank accounts and your vehicle. Along with this, you will likely be able to keep some of the equity in your home due to the homestead exemption.

Note: there are states that have a homestead exemption, allowing you to retain your home even if you own it outright.

Consult with a Columbus Ohio Chapter 7 Bankruptcy Attorney First!

Before you decide for or against filing for Chapter 7 bankruptcy or Chapter 13 bankruptcy, consult with an attorney who can explain how your assets will be treated. This will give you a better idea of the property you can exempt and what you may lose if you move forward.